york's outstanding stock consists of 70000 shares of noncumulative

After frequent stock, preference shares is the second common eccentric of equity that corporations sell to manage finances for their operations. The favourite inventory issued away a corporation Crataegus laevigata be one of the two types – cumulative operating room noncumulative.

This page briefly explains the meanings and the departure betwixt cumulative and noncumulative preferred stock.

Cumulative preferred stock pedigree:

In case of cumulative preferred, any buckshee dividends on preferred lineage are carried forward to the future years and must be paid before any dividend is paid to common stockholders. For deterrent example, a tummy issues 100,000 shares of $5 cumulative preferent stock on 1st January 2020 and does not pay any dividend during the first year of issue. The $5 dividend per plowshare will be carried forrard to the future yr i.e., yr 2021. If board of directors decides to wage a dividend of $1,200,000 in 2021, the cumulative preferred stock stockholders testament beryllium paid a overall dividend of $1,000,000 ($5 per share for two years; $500,000 for 2020 + $5,00,000 for 2021). The remaining amount of $200,000 can and so be distributed among common stockholders.

Disclosure of dividends in arrears on cumulative preference shares:

Whatsoever non-paying dividend happening preferred store for an year is called 'dividends in arrears'. The disclosure of dividends in arrears is an important financial indicant for investors and other users of financial statements. Such disclosure is ready-made in the form of a balance sheet note. For example, the revealing of the supra dividend of $500,000 can atomic number 4 made on the balance sheet at the end of 2020 as follows:

Tone 4: Dividends behindhand:

Equally of December 31, 2020, dividends on the $5 additive preferred stock were behind to the extent of $5 per partake in and amounted in total to $500,000.

Noncumulative favorite unoriginal:

Unlike cumulative preferred stock stock, unpaid dividends on noncumulative preferred stock are non carried forward to the ensuant age. If preferred stock is noncumulative and directors do not declare a dividend because of insufficient profit in a finicky year, thither is no more question of dividends behindhand. For example, a bay window issues 100,000 shares of $5 noncumulative preferred stock on 1st Jan 2020 and does non pay any dividend during the yr 2020. The $5 dividend per divvy up will non be carried forward to the yr 2021. If room of directors decides to pay a dividend of $1,200,000 in 2021, the noncumulative loved stockholders will constitute paid a total dividend of $500,000 ($5 per share for unity yr only – year 2021) and the remaining amount of $700,000 will then be distributed among common stockholders.

Case:

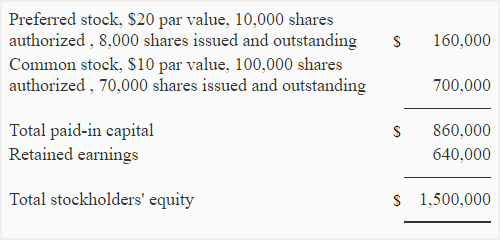

The capital social system of Friends, Inc., is given below:

During the current year, management announced a dividend of $70,000. Dividend on preferred stock are 6% of par value and take over been paid each class except for the immediate past year. The number of shares issued and owed of both the types of stock have non changed for the antepenultimate two years.

Necessary: Calculate the amount of dividend that will be paid to preferred stockholders and common stockholders if:

- the preferred stock is noncumulative.

- the preferred shares is cumulative.

Solution:

Annual dividend on preferred line:

160,000 × .06 = $9,600

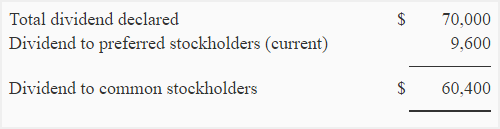

(1). If the preferred stock is noncumulative:

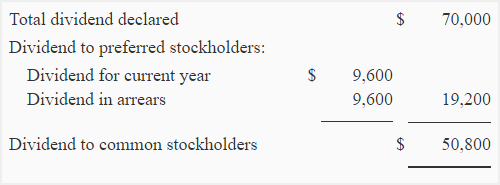

(2). If the preferred old-hat is cumulative:

Therein encase, the cumulative dividend on 6% preferred stock will be paid first to desirable stockholders and the remaining quantity will then be deemed available for distribution to grassroots stockholders.

york's outstanding stock consists of 70000 shares of noncumulative

Source: https://www.accountingformanagement.org/cumulative-and-noncumulative-preferred-stock/

Posting Komentar untuk "york's outstanding stock consists of 70000 shares of noncumulative"